- Let's talk quickly about Leonardo Fibonacci. He is historically credited with giving society The Fibonacci Number series. There is some drama associated with this credit but let's just go with it. The beginning of the list of Fibonacci Numbers is 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, ... If you want more info on Fibonacci Numbers just Google it. There is more info out there than you want to know.

How do Fibonacci Numbers apply to Investing?

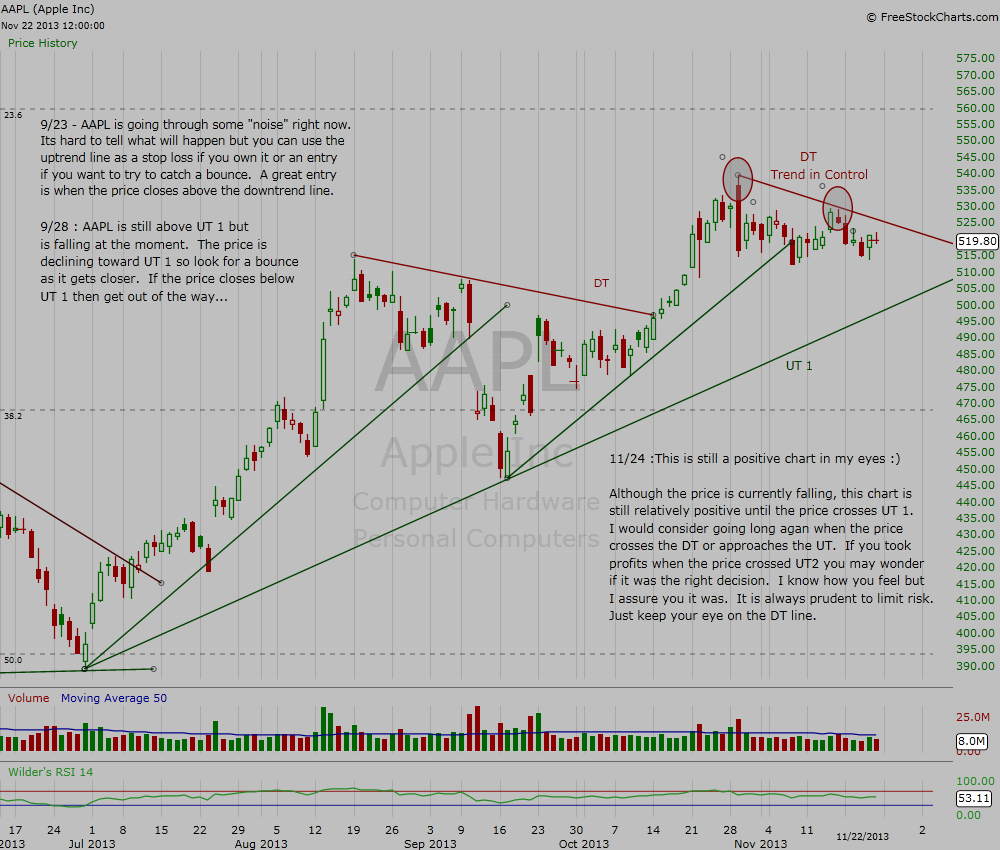

- We all know that stocks go up and down. If you like this blog you probably agree that stocks tend to rise and fall in trends. What you may not have realized is that after a stock price rises to a peak, it may then fall to a Fibonacci Retracement level. There are investors out there who have spent a lot of time on this. Let's just accept it as another form of technical analysis.

If you are curious how the Fibonacci Retracement levels are found then here you go. If not just scroll down to More TWTR Perspective with Fibonacci Retracement.

0.618 or 61.8% : If you divide any (large) Fibonacci Number by the one after it, your answer will be close to 0.618.

0.382 or 38.2% : If you divide any (large) Fibonacci Number by the 2nd number after it, your answer will be close to 0.382

0.236 or 23.6% : If you divide any (large) Fibonacci Number by the 3rd number after it, your answer will be close to 0.236

** There are more retracement & extension levels available on your Fibonacci Retracement tool. Some of those values can be found with similar rules. Other values like the 50% retracement level are not actually Fibonacci Retracement levels. These non-fib levels were added by investors over the years because they are relevant in investing.

More TWTR Perspective with Fibonacci Retracement

- Let's focus on the word retracement. We all know that retracement means a reversal of direction. I think we would all like to know how much of the rise in stock price (uptrend) the reversal will take back. There isn't anyone out there that knows the future before it happens. So take all those price predictions you have read and realize that they are no more than someone's opinion. You can also take this Fibonacci Retracement stuff and realize that it is no more than a potential guideline.

- So how much of a rise in stock price will the reversal take back? Maybe this reversal will take back 23.6 % of the increase. Maybe it will take back 38.2% of the increase. Maybe it will take back 50% or 61.8% of the retracement. We don't know the answer to the question but for some reason, these retracement levels are quite commonly places where the reversal ends and a new rise in the stock price begins.

Here is a Daily chart of TWTR with Fibonacci Retracement levels

|

| Click here for a larger chart of TWTR with Fibonacci Retracement Levels ** Typo : 28.2% retracement level should be 38.2% ** |

- Fibonacci Retracement levels have merit weather you are long or short. In the case of TWTR we can build some perspective into Friday's reversal. We may even be able to use Fibonacci Retracement levels to decide what to do next...

- Let's all agree that Friday's reversal felt POTENT. It may have even felt painful depending on where you went long. But in terms of Fibonacci Retracement, the reversal didn't even take back 38.2% of the uptrend. This could get a lot worse... If you are long the stock you should consider getting out of the way of this reversal. What if the reversal eventually takes back 61.8% or more of the uptrend. Now that would be painful!

- If you want to be long this stock then look for a new uptrend to begin somewhere around one of the Fibonacci Retracement levels. The next lower retracement level from here is the 38.2% retracement at about $61. If TWTR bounces around there then go long again. But wait for the bounce. Don't assume it's going to happen. If the stock continues to fall through the 38.2% retracement then start watching the 50% level at about $57. Continue this method until an uptrend actually begins. You can, and should in my opinion, also look for a new uptrend to begin by using trend lines like the red & green ones on the chart. Yesterday's post "What happened to TWTR ??" should help with the trend line method. Remember, Fibonacci Retracement is nothing more than a potential guide. So use it as such.

- I wouldn't advise anyone to stay long indefinitely and see what happens. The thing everyone forgets is that you can always get out of a stock and then get back into it at a better time. If a better time presents itself. I am not a big proponent of averaging down either. If you get long when a downtrend becomes an uptrend and you use a stop loss incase you were wrong on your entry, then you won't need to average down. This method works on all timeframes. So I am not just talking to the "Fast Money" crowd.

- Let's say that TWTR goes down to about the 50% retracement level and then turns up to begin a new uptrend. What is the next area where you might expect a little turmoil? I would say the next higher retracement level of 38.2% or around $61. If it closes above the $61 area then look for it to get to the 23.6% retracement level or around $66. Are you seeing how this works? What if the price gets back to the All Time High (ATH) of about $75. Then what? Are there any guidelines for how far TWTR may run before another reversal begins? You bet. I am not going to get into it now but that would be called a Fibonacci Extension. Google it if you are interested.

- If you want to be (or already are) short this stock then realize that your max profits may be obtained when the stock price reaches these same Fibonacci Retracement levels. It would be prudent to lighten up on your short position at the 38.2% area for instance because that is one potential level where a new uptrend may begin. If the stock price closes below a retracement level then you should be safe adding to your short again. So if the stock price closes below the 38.2% level or $61 then increase your short position again if you want. You could then see if TWTR gets down to the 50% retracement level of about $57. And so on. You could do this all the way down to the eventual spot where the new uptrend starts. I don't expect that TWTR is going out of business so I do expect that there will be a new uptrend at some point. We all know the uptrend was a great long trade. But it is yet to be seen how good of a trade this downtrend will be for the shorts. Be careful.

Trade What You See...Not What You Think, Or Feel, Or Hope, Or ...

The Trend Is Your Friend...Until It's Not

Limit Risk & Protect Your Profits

The Trend Is Your Friend...Until It's Not

Limit Risk & Protect Your Profits